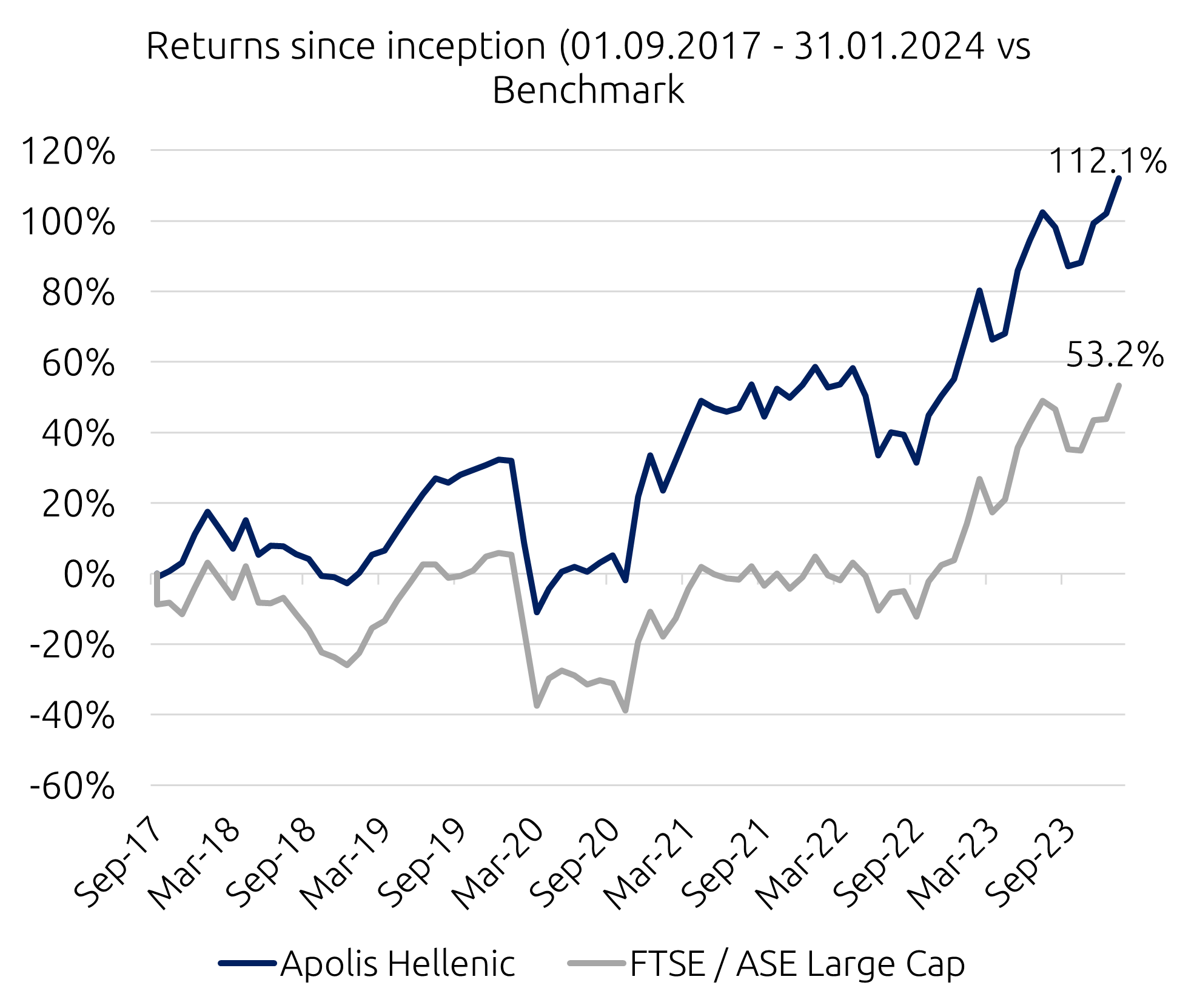

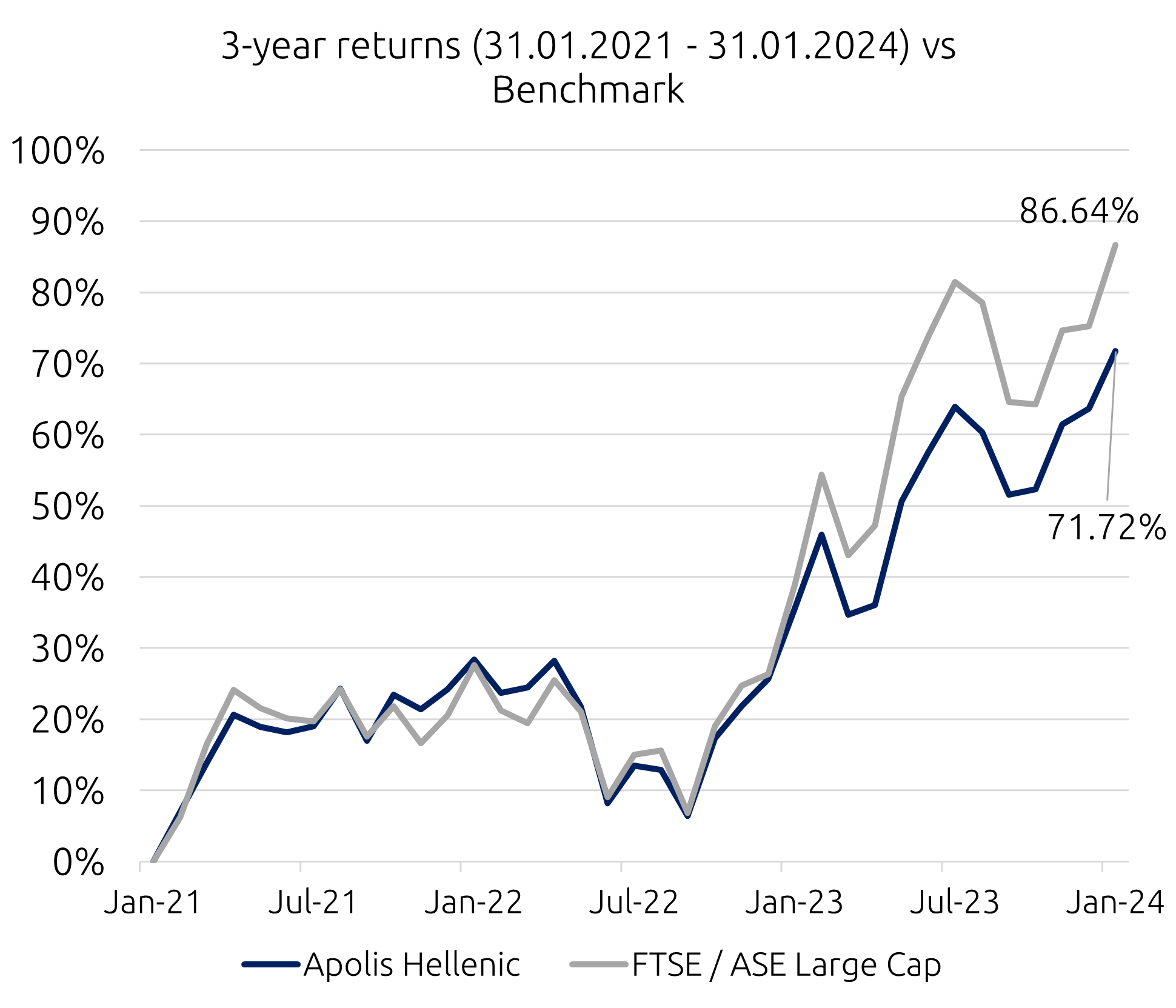

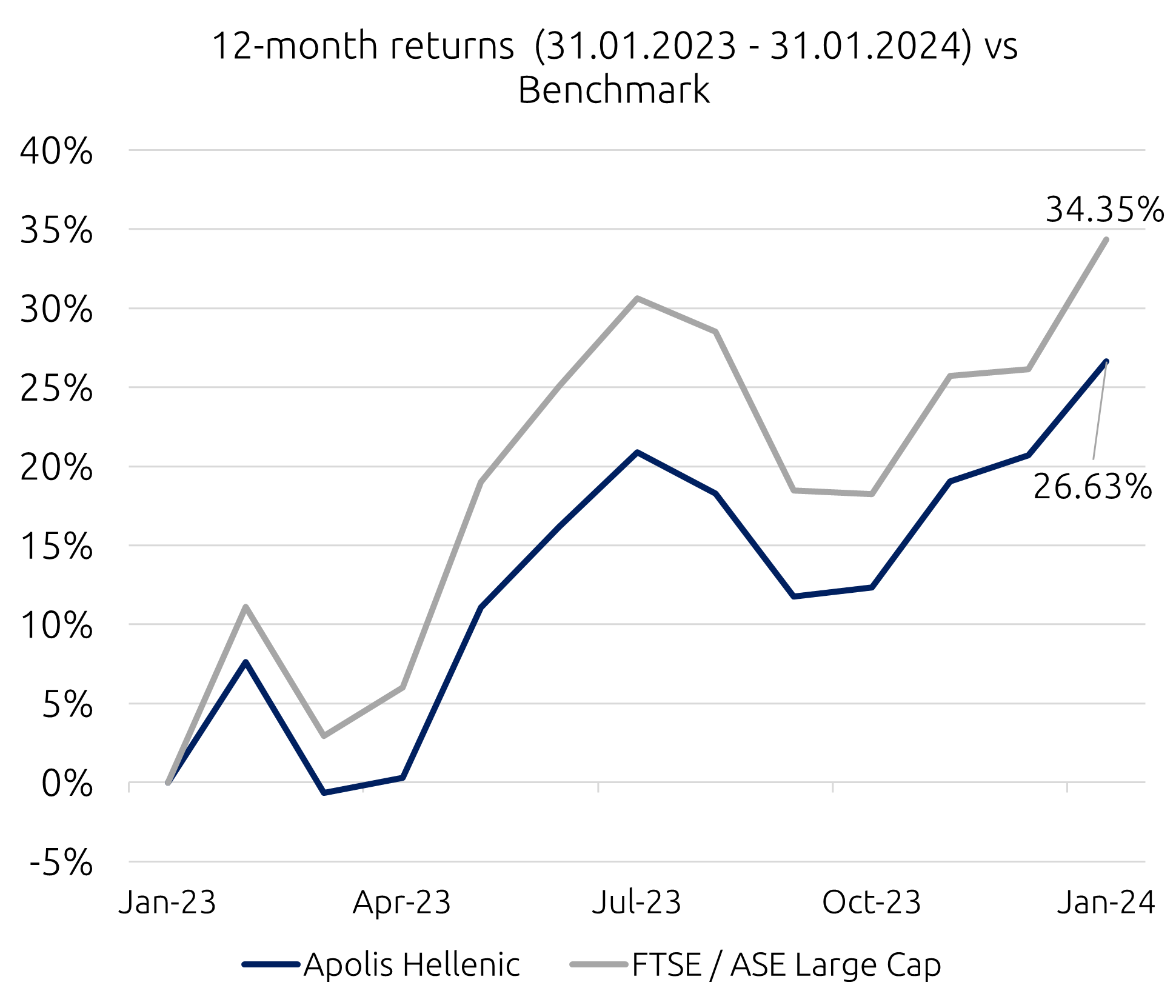

Apolis Hellenic by Iolcus, three years of profitability and consistently FTSE/ASE Large Cap - beating returns!

Apolis Hellenic has achieved significant capital gains for its shareholders in the last three years. Disciplined investment process by Iolcus Investments resulted in the constant outperformance over the FTSE/ASE Large Cap index.

Target

To achieve higher returns than the FTSE/ASE Large Cap index at a lower level of volatility.

Recommended holding period: 5 years.

Investment methodology

Equity exposure depends on the relative dynamics developing between different sectors on a medium-term horizon. We apply index, sector and intermarket arbitrage. We decide on selective short-term investments with the use of strict stop-loss limits.

Investment universe

Greek stocks, Greek government bonds and T-bills, bonds of Greek companies issued in Greece and abroad, index derivatives (both futures and options) and stock futures listed in the Athens Stock Exchange.

Risk management

Target ex-ante volatility levels below these of the FTSE/ASE Large Cap index.

Leverage is limited by the volatility target of the fund and its use is restricted to arbitrage and spread trading.

Selectively, we apply risk hedging strategies through short positions in stocks and index futures.

More about Apolis funds

AIFS DO NOT HAVE GUARANTEED RETURNS AND PAST PERFORMANCE IS NOT A GUARANTEE OF FUTURE RESULTS

Do you have questions about your existing investments?

Contact us